Traxia, which is planning to disrupt the global trade finance using blockchain technology, has launched its ICO on March 19, 2018. It will be one of the major real-world projects that is going to be employed on Cardano platform. There are over $43 trillion of invoices sitting in companies’ balance sheets waiting to be paid. This lack of liquidity has often proven detrimental to a sellers’ short-term cash flow, especially for small and medium enterprises (SMEs). The Traxia ecosystem aims to facilitate those short-term assets to be digitized, tokenized and ultimately to be tradeable in a decentralized market.

Traxia, which is planning to disrupt the global trade finance using blockchain technology, has launched its ICO on March 19, 2018. It will be one of the major real-world projects that is going to be employed on Cardano platform. There are over $43 trillion of invoices sitting in companies’ balance sheets waiting to be paid. This lack of liquidity has often proven detrimental to a sellers’ short-term cash flow, especially for small and medium enterprises (SMEs). The Traxia ecosystem aims to facilitate those short-term assets to be digitized, tokenized and ultimately to be tradeable in a decentralized market.

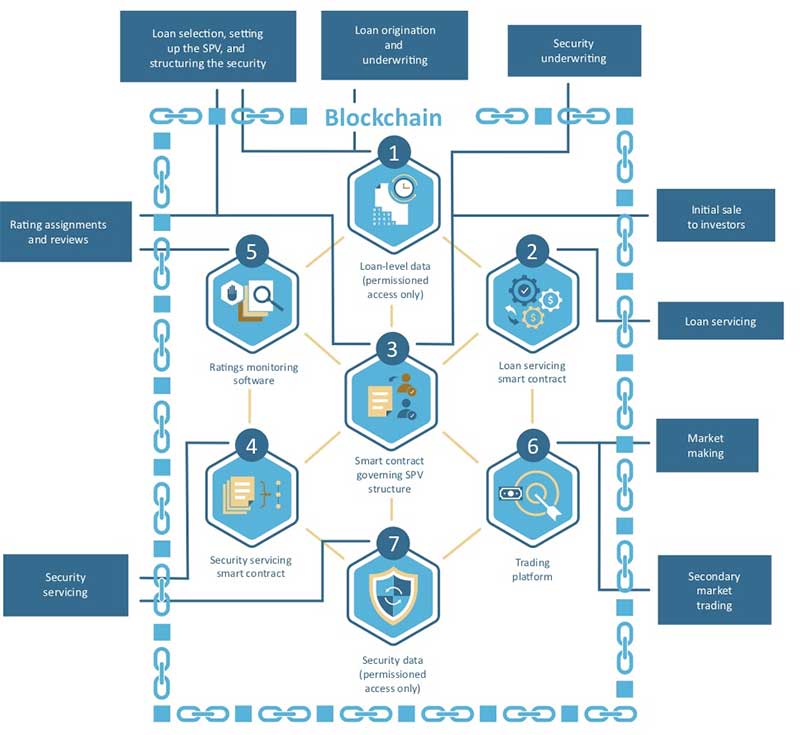

Traxia envisions a system where sellers upload their invoice, buyers approve it with their private keys, issuing providers write it into a smart contract, liquidity providers distribute cash liquidity, Listing providers manage the marketplace and Investors trade the newly created digital assets.To put it in simpler terms, it can be considered as factoring on a blockchain.

What is Trade Finance?

The term “trade finance” is generally reserved for bank products that are specifically linked to underlying international trade transactions (exports or imports). Trade finance products typically carry short-term maturities, which reflect the typical shipping times and payment terms of 30, 60 or 90 days or more.

Traxia’s plan

Traxia’s solution: a decentralized trade finance ecosystem

The vision of Traxia is to establish an open and decentralized ecosystem that can improve global trade finance. Traxia combines blockchain and an open, connected IT architecture to create a new ecosystem for trade finance. It allows companies to create smart contracts — automated, self-executing digital contracts that trigger payments and receipts in real time as goods move through the supply chain.

Traxia creates a new trade finance platform that operates through smart contracts running on a blockchain. Those smart contracts hold information such as volume and duration of an underlying trade, while also becoming interoperable with existing Enterprise Resource Planning (ERP) Systems, Payment Networks such as SWIFT, [Ripple Settlement System] and others.. Traxia is also a tool to model and automate business processes to save time, costs and generate a higher efficiency for corporates along their respective supply chains.

LiqEase

Award winningLiqEase is a Limited company registered in Hong Kong since 2017. LiqEase operates a for profit businesses and is building the gateways and applications to connect and be part of the Traxia ecosystem. It is the technology provider within the Traxia ecosystem, providing issuing and listing services to buyers, sellers and investors.

LiqEase has thus far built a simple and user-friendly Web Interface that can be used today by buyers and sellers to upload their invoice. In the backend LiqEase is running a blockchain application layer for various blockchains such as Ethereum and will build upon Cardano when ready. LiqEase Limited operates as a Listing provider i.e. running an Over-the-Counter market, which targets professional investors as defined by the regulators in Hong Kong.

As the assets created on the platform are merely a digital representation of a real trade asset issued by the buyers/sellers, there is no need for an International Security Identification Number (ISIN). In addition, there is no custodian as the digital version of the asset has already been digitally signed by the supplier and/or buyer with their respective private keys and recorded on a blockchain. As the blockchain is distributed, this adds an additional layer of trust as compared to a traditional central custodian safekeeping the asset. The asset is then listed on the marketplace instantly and settlement times can easily be reduced to minutes rather than days.

About Traxia

Traxia is a non-profit foundation being established under the laws of Switzerland. It is the creator and initiator of the blockchain model. The Traxia foundation’s mission is to promote and support the Traxia platform through development and education and provide buyers, sellers and investors around the world with a more accessible, transparent and more trustworthy system to engage in global trade.

Real-world use cases

In one of its first use cases, LiqEase was the Issuing Provider and Listing provider for a Porsche Digital Innovation Project (the Buyer) who listed a 30 days invoice worth around $50.000 in total. The Seller was VOK Dams and a 3rd party corporate investor was the Liquidity Provider. The smart contract was registered on the Proof Ethereum Blockchain under the transaction number:

http://www.proofsidechain.com/#/transaction/0x7453e318039cc04c08cfb475ec62b2107bc9898361138de71eef32285a7b9475.

LiqEase is currently working on another project involving another German car manufacturer, as well as on projects in the Fast Moving Consumer Goods (FMCG) sector. LiqEase expects to work on a number of different financing projects during 2018. Focusing its activity on the multi-billion-dollar trade corridor between Europe and China.

Business Strategy

• Traxia will work to accepted and used by sellers to finance their B2B trade.

• Educate the initial client base and foster word of mouth campaigns through the creation of a referral program.

• Broader market adoption by targeting global investors such as hedge funds. The more Traxia is recognized as a reliable ecosystem, the easier it will be to expand globally.

Traxia Membership Token (TMT)

Traxia Membership Token (TMT) is the utility token issued by Traxia Foundation (Swiss law). The token gives access to Traxia ecosystem. Each time an Issuing Provider adds a new invoice to the system, TMT has to be purchased at an exchange to settle access fees.

To fund the initial operation and the creation of the Traxia platform, the developers are offering maximum of one billion (1,000,000,000) tokens.

70% of the tokens will be eventually allocated amongst the community.

20% will be allocated to the foundation creation, development team, early backers.

10% will be allocated to treasury with the purpose of providing TMT Liquidity if

Necessary, as well as being a contingency fund

United States

United States United Kingdom

United Kingdom